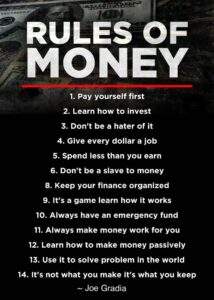

The rules of money can vary depending on individual philosophies, cultural perspectives, and economic systems, but here are some fundamental principles that are often considered:

The rules of money can vary depending on individual philosophies, cultural perspectives, and economic systems, but here are some fundamental principles that are often considered:

1. **Earn More than You Spend**: The basic principle of budgeting is to ensure that your income exceeds your expenses to avoid debt.

2. **Save and Invest**: Setting aside a portion of your income for savings and investments can help grow your wealth over time. The earlier you start, the more you benefit from compound interest.

3. **Diversify Your Investments**: Don’t put all your eggs in one basket. Spreading your investments across different asset classes can reduce risk.

4. **Understand the Value of Money**: Recognize that money is a tool that can help you achieve your goals, but it’s not the ultimate goal in itself.

5. **Create a Budget**: Tracking your income and expenses helps you understand where your money goes and allows you to make informed financial decisions.

6. **Avoid High-Interest Debt**: Credit card debt and other high-interest loans can quickly spiral out of control. It’s important to manage debt wisely.

7. **Plan for the Future**: Retirement planning and having an emergency fund are essential for financial security.

8. **Educate Yourself**: Financial literacy is crucial. Understanding how money works, including interest rates, inflation, and investment strategies, can empower you to make better financial decisions.

9. **Be Mindful of Lifestyle Inflation**: As your income increases, it can be tempting to increase your spending. Maintain a balanced lifestyle to continue saving and investing.

10. **Give Back**: Philanthropy and charitable giving can provide personal fulfillment and positively impact your community.

These rules can serve as a foundation for managing personal finances and building wealth over time.

~ Joe Gradia

Pain, whether physical or emotional, can be a formidable challenge. Here are some strategies to help you push through:

Pain, whether physical or emotional, can be a formidable challenge. Here are some strategies to help you push through: